Jun 30, Join Costco

Updated: 2011-06-30 18:05:32

Join Costco, a vital weapon for frugal living

Join Costco, a vital weapon for frugal living Join Costco, a vital weapon for frugal living

Join Costco, a vital weapon for frugal living Retirement hobbies, do not overlook this crucial part of every successful retirement plan

Retirement hobbies, do not overlook this crucial part of every successful retirement plan Ha! You probably thought this was about vegetarianism, but it isn’t. I recently got a pingback from a Brazen Careerist post on her opinion on bad job advice lobbing me in with the baby boomers. Crickey! I thought I was older than that. Actually, I’m only 33 and so at the edge between Generations X [...]

Ha! You probably thought this was about vegetarianism, but it isn’t. I recently got a pingback from a Brazen Careerist post on her opinion on bad job advice lobbing me in with the baby boomers. Crickey! I thought I was older than that. Actually, I’m only 33 and so at the edge between Generations X [...] It goes like this Month after month after month after month … Do you want to know more?

It goes like this Month after month after month after month … Do you want to know more? Some time ago I bought an old (like grandparents-old) Disston for $50 on eBay (if you’re lucky, you might be able to buy one at a yard sale for a few bucks) and I have slowly been accumulating and building the necessary tools to sharpen it. Specifically, A saw vise — you used to be [...]

Some time ago I bought an old (like grandparents-old) Disston for $50 on eBay (if you’re lucky, you might be able to buy one at a yard sale for a few bucks) and I have slowly been accumulating and building the necessary tools to sharpen it. Specifically, A saw vise — you used to be [...] I just stumbled on an interesting post over at Moneymonk with a title suggesting that money only exists to be spent. I disagree. I think money also serves to delineate the wealthy from the broke. To reiterate the definitions: wealthy means having having enough money to buy everything you want (I’m wealthy), broke means not [...]

I just stumbled on an interesting post over at Moneymonk with a title suggesting that money only exists to be spent. I disagree. I think money also serves to delineate the wealthy from the broke. To reiterate the definitions: wealthy means having having enough money to buy everything you want (I’m wealthy), broke means not [...] The following was a consequence not so much of a brilliant insight but more of external circumstances. When we moved into the RV, we obviously didn’t have a lot of space(*), so many things were packed into moving boxes and stored outside in the garden shed. (*) Although I think if we put everything in [...]

The following was a consequence not so much of a brilliant insight but more of external circumstances. When we moved into the RV, we obviously didn’t have a lot of space(*), so many things were packed into moving boxes and stored outside in the garden shed. (*) Although I think if we put everything in [...] Over the past several decades, the stock market has become an enormously popular vehicle for retirement savings. I rest my case. Okay, you want more detail. First consider the graph in this link. You will note that during most of the past century, stocks have traded with P/E’s between 5 and 25 although it would [...]

Over the past several decades, the stock market has become an enormously popular vehicle for retirement savings. I rest my case. Okay, you want more detail. First consider the graph in this link. You will note that during most of the past century, stocks have traded with P/E’s between 5 and 25 although it would [...] Unlike 401(k) accounts which are permitted to offer participant loans, the IRS does not permit IRA loans. However, with a little creativity, this article shows you how to use your retirement account as a source of loan funds. Note that the following tactic is not a recommendation but simply a solution for people who get [...]

Unlike 401(k) accounts which are permitted to offer participant loans, the IRS does not permit IRA loans. However, with a little creativity, this article shows you how to use your retirement account as a source of loan funds. Note that the following tactic is not a recommendation but simply a solution for people who get [...] Diversification is often hailed as a great safety feature of modern investment theory. It almost seems like the belief in diversification as the great portfolio has taken taken on the quality, or rather lack thereof, of blind faith. Keep in mind that diversification really requires uncorrelated assets. If a large fraction of people buy the [...]

Diversification is often hailed as a great safety feature of modern investment theory. It almost seems like the belief in diversification as the great portfolio has taken taken on the quality, or rather lack thereof, of blind faith. Keep in mind that diversification really requires uncorrelated assets. If a large fraction of people buy the [...] These days not too many people get their health insurance on the free market. Instead many have no coverage at all and many get it through their employer where it acts as a set of golden handcuffs, that is, the only thing preventing some people from quitting their jobs. Indeed, some still have a job [...]

These days not too many people get their health insurance on the free market. Instead many have no coverage at all and many get it through their employer where it acts as a set of golden handcuffs, that is, the only thing preventing some people from quitting their jobs. Indeed, some still have a job [...] In the past I have mentioned the importance of selecting hobbies, activities really, in such a way that they do not cost you money, rather they should be free or at best actually make you money. Disclaimer: Yes, I know that my two sports (inline hockey and shinkendo) cost me money and thus are not [...]

In the past I have mentioned the importance of selecting hobbies, activities really, in such a way that they do not cost you money, rather they should be free or at best actually make you money. Disclaimer: Yes, I know that my two sports (inline hockey and shinkendo) cost me money and thus are not [...] Occasionally, albeit rarely, I get a comment that one has a duty to work insofar one able-bodied vis-a-vis able-brained. This is a fairly complex comment which suggests either socialist or collectivist beliefs, that is, everybody has a duty to work and a right to eat in the sense that first and foremost people have a [...]

Occasionally, albeit rarely, I get a comment that one has a duty to work insofar one able-bodied vis-a-vis able-brained. This is a fairly complex comment which suggests either socialist or collectivist beliefs, that is, everybody has a duty to work and a right to eat in the sense that first and foremost people have a [...] I’m a long time lurker on Jacob’s blog and in the forums. In fact, I’ve been following ERE for years and follow a large portion of the methods in my own life. I would like to be financially independent as soon as possible like many others here. But I still applied to and will attend [...]

I’m a long time lurker on Jacob’s blog and in the forums. In fact, I’ve been following ERE for years and follow a large portion of the methods in my own life. I would like to be financially independent as soon as possible like many others here. But I still applied to and will attend [...] Retire in Arizona cheaply...take a good look at affordable park models

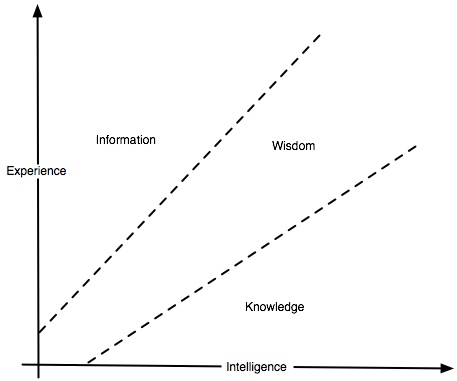

Retire in Arizona cheaply...take a good look at affordable park models Experience without intelligence is just information or a walking encyclopedia. Intelligence without experience is knowledge and knowledge without experience is unwise. Experiences can be bought (and some say they are better than stuff). Intelligence can not be bought with money (but some say it can be developed through effort and time). Ideally one should strive [...]

Experience without intelligence is just information or a walking encyclopedia. Intelligence without experience is knowledge and knowledge without experience is unwise. Experiences can be bought (and some say they are better than stuff). Intelligence can not be bought with money (but some say it can be developed through effort and time). Ideally one should strive [...] Facing retirement? Financial planning gives a sense of security now and a secure financial future as you age. Why boomers need to plan -- NOW!

Facing retirement? Financial planning gives a sense of security now and a secure financial future as you age. Why boomers need to plan -- NOW! Cheap Arizona retirement...take a good look at affordable park models

Cheap Arizona retirement...take a good look at affordable park models Can I retire early?...If you don't retire early you may not live long

Can I retire early?...If you don't retire early you may not live long Tell us your frugal retirement stories, share it with others.

Tell us your frugal retirement stories, share it with others. The best ways to retire early is to ask yourself two questions

The best ways to retire early is to ask yourself two questions Cheap places to retire are not about sacrifice...they are cheap in name only

Cheap places to retire are not about sacrifice...they are cheap in name only Arizona retirement community...we found the best Arizona retirement community and we can prove it

Arizona retirement community...we found the best Arizona retirement community and we can prove it Arizona Park model living... A stationary cruise ship in the desert

Arizona Park model living... A stationary cruise ship in the desert How to retire early starts with realizing how little you really need

How to retire early starts with realizing how little you really need Learn how you can use the CSRS Voluntary Contributions program to put away money for retirement. You can also transfer CSRS VCP to an IRA or Roth IRA, find out how.

Learn how you can use the CSRS Voluntary Contributions program to put away money for retirement. You can also transfer CSRS VCP to an IRA or Roth IRA, find out how. Do you make too much money for a Roth IRA? The CSRS VCP program is a unique benefit for federal employees that can be used to max-fund a Roth IRA, even if you make 'too much money'.

Do you make too much money for a Roth IRA? The CSRS VCP program is a unique benefit for federal employees that can be used to max-fund a Roth IRA, even if you make 'too much money'. Looking for once resource with all the answers to your CSRS Voluntary Contributions Program questions? Learn more about the ebook, The Best Kept Secret in CSRS

Looking for once resource with all the answers to your CSRS Voluntary Contributions Program questions? Learn more about the ebook, The Best Kept Secret in CSRS